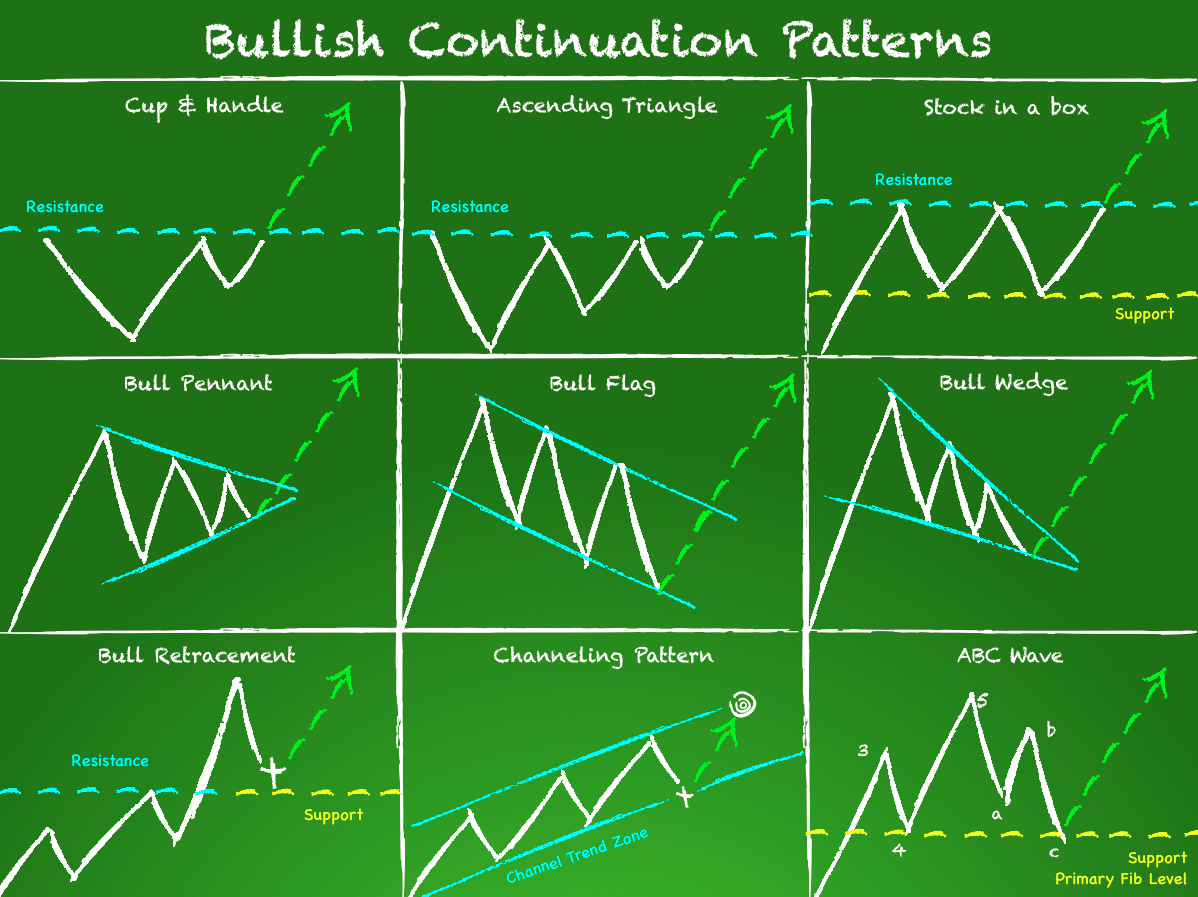

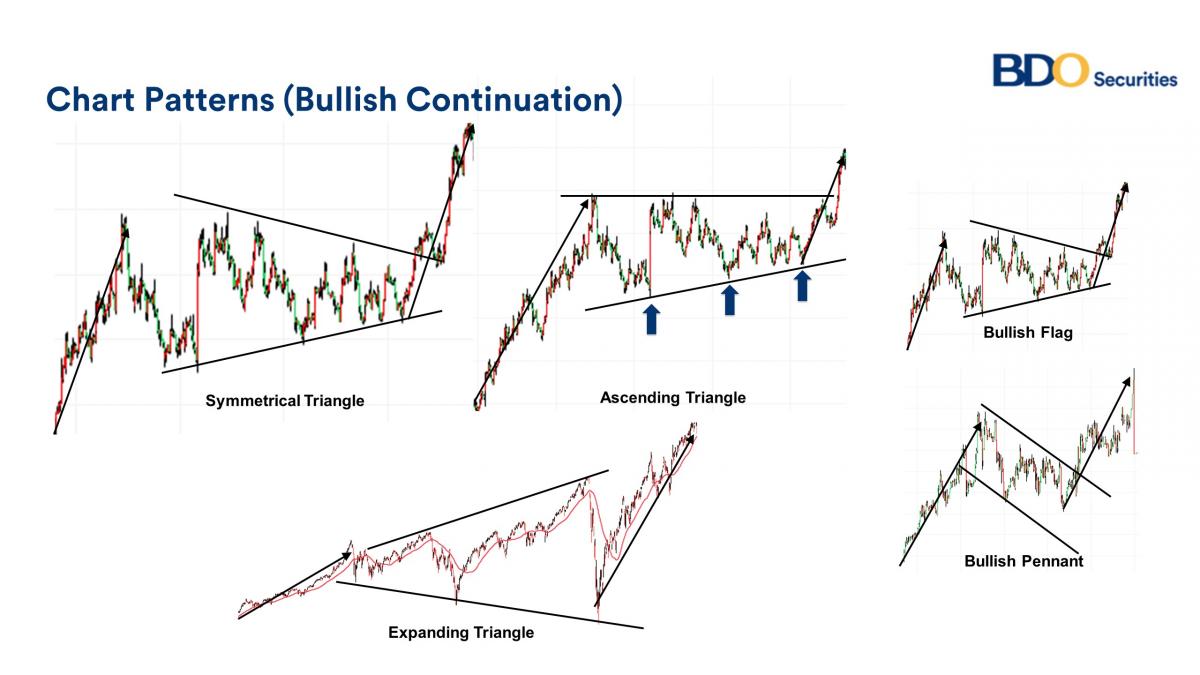

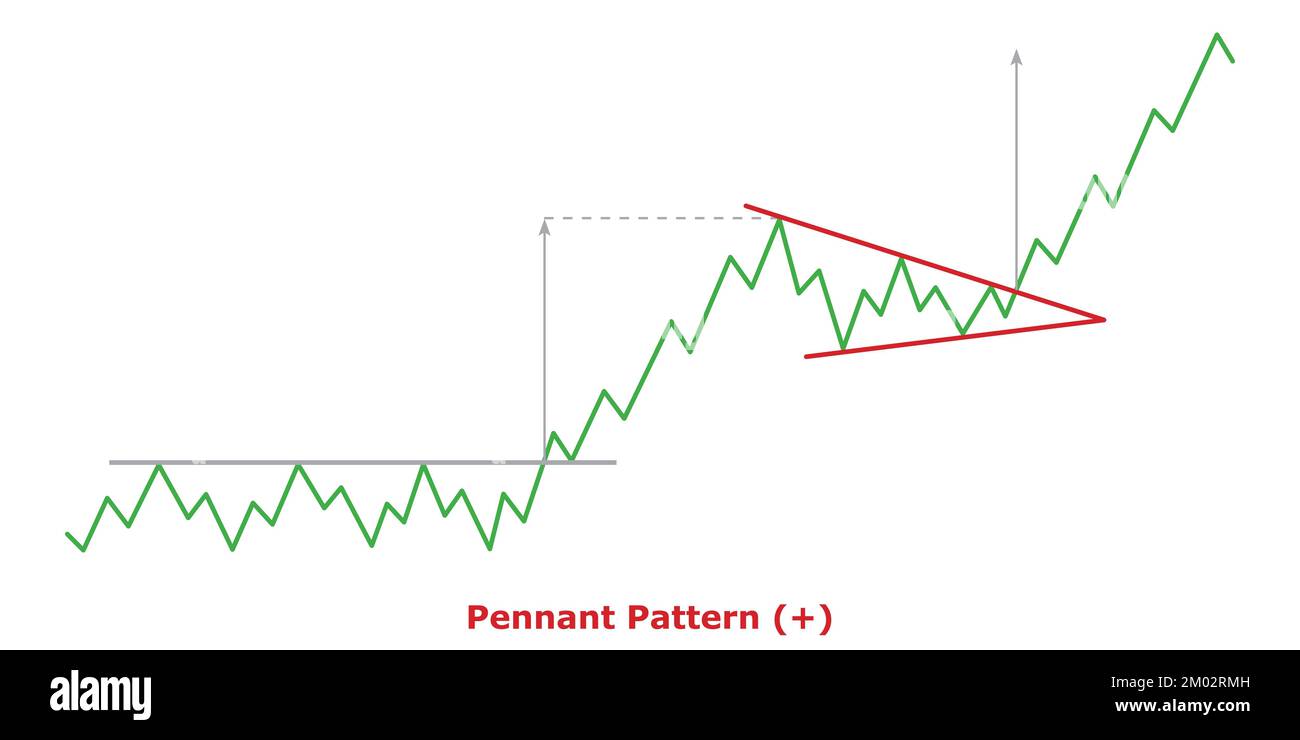

Web a bullish continuation pattern is a chart pattern used by technical analysts that indicates a pause or consolidation in an uptrend before the market continues its upward movement. For example, the price of an asset might consolidate after a strong rally, as some bulls decide to take profits and others want to see if their buying interest will prevail. Web the bullish continuation pattern occurs when the price action consolidates within a specific pattern after a strong uptrend. Web a bullish pennant pattern is a continuation chart pattern that appears after a security experiences a large, sudden upward movement. This pattern indicates strong buying.

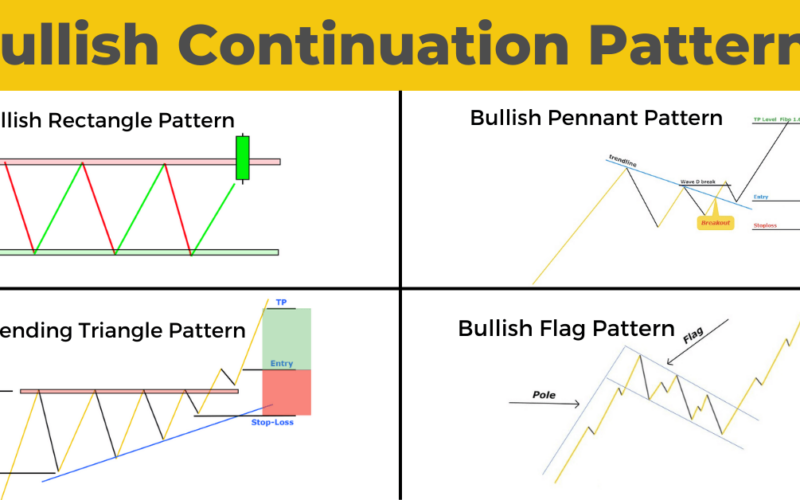

Traders try to spot these patterns in the middle of an existing trend, and. The most profitable chart pattern is the bullish rectangle top, with a 51% average profit. For example, the price of an asset might consolidate after a strong rally, as some bulls decide to take profits and others want to see if their buying interest will prevail. The continuation of a trend is secured once the price action breaks out of the consolidation phase in an explosive breakout in the same direction as the prevailing trend. Web research shows the most reliable and accurate bullish patterns are the cup and handle, with a 95% bullish success rate, head & shoulders (89%), double bottom (88%), and triple bottom (87%).

Web the bullish continuation pattern occurs when the price action consolidates within a specific pattern after a strong uptrend. The most profitable chart pattern is the bullish rectangle top, with a 51% average profit. Web a bullish pennant pattern is a continuation chart pattern that appears after a security experiences a large, sudden upward movement. Web continuation patterns are price patterns that show a temporary interruption of an existing trend. It develops during a period of brief consolidation, before.

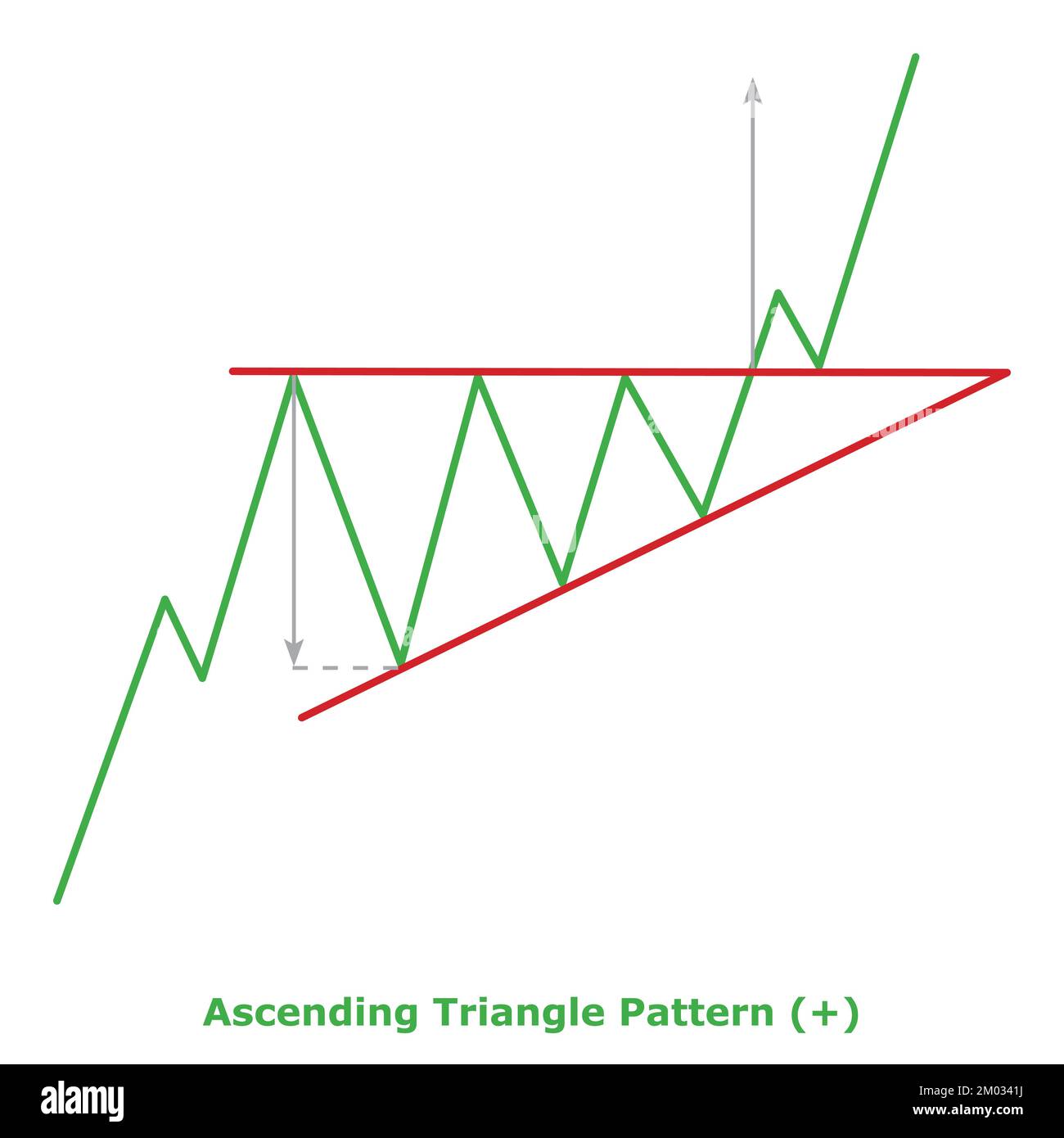

It develops during a period of brief consolidation, before. Web research shows the most reliable and accurate bullish patterns are the cup and handle, with a 95% bullish success rate, head & shoulders (89%), double bottom (88%), and triple bottom (87%). The continuation of a trend is secured once the price action breaks out of the consolidation phase in an explosive breakout in the same direction as the prevailing trend. Web continuation patterns are an indication traders look for to signal that a price trend is likely to remain in play. Web the bullish continuation pattern occurs when the price action consolidates within a specific pattern after a strong uptrend. Web a bullish continuation pattern is a chart pattern used by technical analysts that indicates a pause or consolidation in an uptrend before the market continues its upward movement. The most profitable chart pattern is the bullish rectangle top, with a 51% average profit. Web a bullish pennant pattern is a continuation chart pattern that appears after a security experiences a large, sudden upward movement. Traders try to spot these patterns in the middle of an existing trend, and. For example, the price of an asset might consolidate after a strong rally, as some bulls decide to take profits and others want to see if their buying interest will prevail. This pattern indicates strong buying. Web continuation patterns are price patterns that show a temporary interruption of an existing trend.

Web The Bullish Continuation Pattern Occurs When The Price Action Consolidates Within A Specific Pattern After A Strong Uptrend.

Web continuation patterns are an indication traders look for to signal that a price trend is likely to remain in play. Web continuation patterns are price patterns that show a temporary interruption of an existing trend. The continuation of a trend is secured once the price action breaks out of the consolidation phase in an explosive breakout in the same direction as the prevailing trend. For example, the price of an asset might consolidate after a strong rally, as some bulls decide to take profits and others want to see if their buying interest will prevail.

It Develops During A Period Of Brief Consolidation, Before.

This pattern indicates strong buying. Web a bullish continuation pattern is a chart pattern used by technical analysts that indicates a pause or consolidation in an uptrend before the market continues its upward movement. Web a bullish pennant pattern is a continuation chart pattern that appears after a security experiences a large, sudden upward movement. Web research shows the most reliable and accurate bullish patterns are the cup and handle, with a 95% bullish success rate, head & shoulders (89%), double bottom (88%), and triple bottom (87%).

Traders Try To Spot These Patterns In The Middle Of An Existing Trend, And.

The most profitable chart pattern is the bullish rectangle top, with a 51% average profit.